Capital One Venture Review

Nomadic Matt has partnered with CardRatings for our coverage of credit card products. Some or all of the card offers on this page are from advertisers and compensation may impact how and where card products appear on the site. Nomadic Matt and CardRatings may receive a commission from card issuers.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.

Earning and using points and miles is my favorite way to keep my travel costs low. I talk about it a lot on this website, in my email newsletters, and on social media. Naturally, people ask me all the time, “Matt, what’s the absolute best card?”

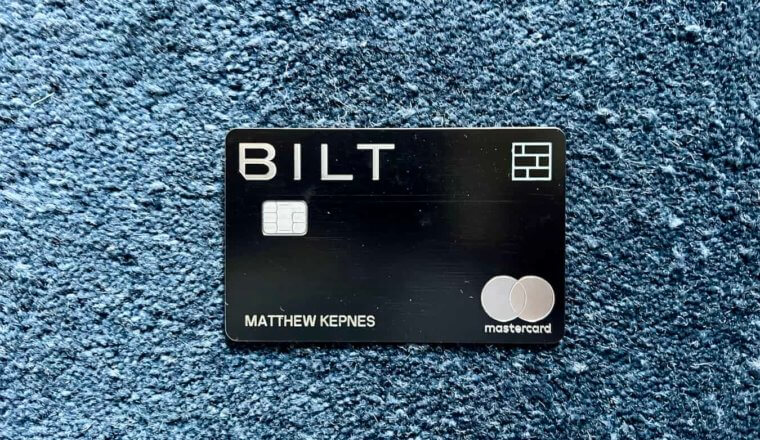

While I have a few personal favorites (like the Bilt Rewards card and the Chase Sapphire Preferred® Card), picking the perfect travel card means choosing the one that’s best for you.

That means that the best card for one person may not be the best for another.

For example, I’m an avid collector of points and miles, so I like to keep track of all the different systems and earning categories. It’s fun for me to make sure I get the most out of my points.

But for many people, that seems daunting and tedious. They just want an easy-to-use, hassle-free card that they don’t have to think about and can use for all purchases.

That’s why today, I want to talk about the Capital One Venture card, which does just that!

Table of Contents

What is the Capital One Venture?

The card_name is a travel rewards credit card. With it, you can earn 2x miles on all purchases across the board — a rarity in a card — making it easy to rack up miles. Plus, you don’t have to keep track of earning rates differing across categories (such as with some cards, with which you might earn 2x on travel, 3x on dining, and so forth).

Additionally, this card offers:

- bonus_miles_full

- 5x miles per dollar on hotels and rental cars booked through Capital One Travel

- Transfer miles to any of 15+ travel partners

- Up to $100 credit for Global Entry or TSA PreCheck

- No foreign transaction fees

Overall, it’s an easy-to-use card that is perfect for travelers new to collecting points and miles (as well as travelers who want something simple and straightforward).

Using Your Capital One Miles

With this card, you’ll earn Capital One miles. You can use them like you would any other rewards program: to get cash back, book travel directly, or transfer them to travel partners.

The easiest option is to redeem your miles for travel in the Capital One travel portal, which works like booking through Expedia or any other online travel agency. Doing so is very straightforward. You simply search for and book your flight, hotel, or rental car and choose “miles” as your payment method. It’s basically like using your miles as cash, at a value of one cent per mile.

Another option is to make a travel purchase and then erase it from your statement. It works like this: for 90 days after making a travel purchase, you can use your miles to wipe that purchase off your statement at a redemption rate of one cent per mile. After 90 days, and for all other purchases, you can use miles as cash back, at a redemption rate of .5 cents per mile (but avoid doing this as it’s not a good value).

Both options are super easy to implement, which is why this is a great card for points and miles newbies. And if this is the only way that you’ll use your miles, go for it! Using them is better than letting them sit around.

However, you can usually get more for your miles when you transfer them to Capital One’s transfer partners.

Taking Advantage of Capital One’s Travel Partners

The ability to transfer to travel partners is what makes Capital One miles valuable. While the actual value varies based on what you book, you can usually find airline and hotel redemptions worth much more than the aforementioned 1 cent per mile.

To give a real-life example, with 30,000 miles, you might be able to get from Seattle to Paris on an economy ticket when redeemed through the portal. But if you transfer miles to one of Capital One’s partner airlines, you can take advantage of flash deals and saver space, potentially finding the same fare for up to 50% fewer miles.

Unless it’s a super cheap flight or hotel room (less than $150 USD), I always transfer miles to Capital One’s travel partners, especially when booking business class flights or fancy hotel rooms. You just get more bang for your buck.

Transferring to travel partners is a bit more work than using the portal, but there are more tools than ever to help you maximize your miles (such as point.me for finding flights and Awayz for finding award hotel stays).

Here are Capital One’s current travel partners:

- Accor Live Limitless

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Choice Privileges

- Emirates Skywards

- Etihad Airways Guest

- EVA Air Infinity MileageLands

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Portugal Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

While this is a solid list of travel partners, it’s worth noting that Capital One does not partner with any major US airlines. While there are ways to fly on US airlines by booking through one of their partners (such as using Flying Blue to book a Delta flight), this is a bit higher-level than I imagine most users of this card will be looking to do.

If you want to be able to transfer directly to US airlines (such as Delta, United, or Southwest), you may want to look into a travel card that partners with one or more of these airlines.

Other Perks and Benefits of the Capital One Venture

For a card with a low annual fee (it’s just $95 USD), the card_name packs a punch in terms of additional benefits. It comes with:

- Travel accident insurance

- Car rental insurance

- Up to a $100 credit for Global Entry or TSA PreCheck® every four years (which immediately recoups the cost of the annual fee for your first year!)

Pros of the Capital One Venture

- Great rewards-earning rates

- Large welcome offer

- Low annual fee ($95 USD)

- 15 transfer partners

- Travel accident and car rental insurance

- Up to a $100 credit for Global Entry or TSA PreCheck®

- No foreign transaction fees

Cons of the Capital One Venture

- Must use Capital One’s Travel Portal to take advantage of some benefits (e.g., 5x miles per dollar on hotels and rental cars)

- Transfer partners are a bit lacking (no US airlines and not the best hotels)

Who is This Card For?

The card_name is great for newer mile collectors or infrequent travelers who want a straightforward, easy-to-use card. The Capital One Venture makes things simple with two miles earned across the board for every dollar spent, so you don’t have to worry about keeping track of earning rates across different spending categories.

On the flip side, this card is not a great primary card for avid points and miles collectors who are looking to maximize earnings across all categories. (Though it could be a great card to hold in addition to other cards. That way, you’re ensuring you get at least 2x miles on all purchases.)

As with any credit card, you should not get this card if you’re already carrying a balance or plan to carry a balance. Interest rates for travel credit cards are notoriously high, and the miles just aren’t worth it if you’re paying interest each month.

This card is also not for anyone with poor credit, as you need good or excellent credit to qualify. (If that’s you, check out this list of the best credit cards for bad credit, so you can start improving your score today.)

The card_name is the perfect card for travelers looking for something straightforward and easy to use. If you’re new to points and miles, this card keeps things simple, so you can focus on using those miles for free travel!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

Nomadic Matt has partnered with CardRatings for our coverage of credit card products. Some or all of the card offers on this page are from advertisers and compensation may impact how and where card products appear on the site. Nomadic Matt and CardRatings may receive a commission from card issuers.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.